The State of REITs: November 2021 Edition

- REITs have achieved positive returns in 9 of the first 10 months of 2021, including a +4.25% average return in October.

- Large cap (+7.60%) and Mid cap REITs (+4.88%) surged in October while micro caps (-1.35%) badly underperformed.

- 79.78% of REIT securities had a positive total return in October.

- Self Storage (+12.91%), Industrial (+11.45%) and Student Housing (+10.88%) all achieved double-digit gains in October. Timber (-5.02%) and Land (-1.64%) saw the largest declines.

- The average REIT NAV discount narrowed to -1.52% in September. The median NAV discount flipped to a premium of +1.37% during the month.

REIT Performance

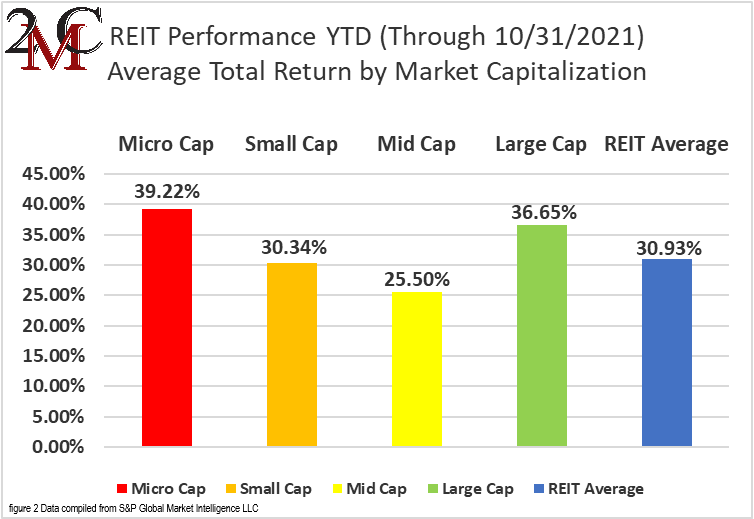

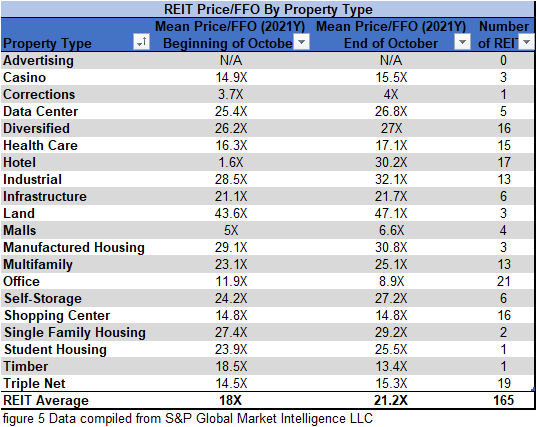

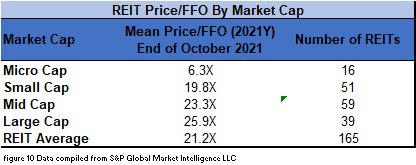

The REIT sector bounced back from its first negative month of 2021 (September) with a strong total return in October (+4.25%). The broader market, however, bounced back even stronger in October. The NASDAQ (+7.27%), S&P 500 (+6.91%), and Dow Jones Industrial Average (+5.84%) all achieved even larger gains. The market cap weighted Vanguard Real Estate ETF (VNQ) significantly outperformed the average REIT in October (+7.13% vs. +4.25%) and has nearly caught up to the YTD performance of the average REIT (+30.87% vs. +30.93%). The spread between the 2021 FFO multiples of large cap REITs (25.9x) and small cap REITs (19.8x) widened in October as multiples rose 2 turns for large caps, but only expanded by 1.5 turns for small caps. In this monthly publication, I will provide REIT data on numerous metrics to help readers identify which property types and individual securities currently offer the best opportunities to achieve their investment goals.

16 out of 20 Property Types Yielded Positive Total Returns in October

80% of REIT property types averaged a positive total return in October, with a wide 17.93% total return spread between the best and worst performing property types. Timber (-5.02%) and Land (-1.64%) suffered the worst losses in October. Timber was dragged down by the collapse of CatchMark Timber Trust (CTT), which plummeted -27.89% due to the unfavorable terms by which CTT exited a very large investment as well as the disappointing loss of the management contract connected to that deal. The other 3 Timber REITs, however, all saw single-digit gains.

Performance of Individual Securities

Washington Prime Group (WPG) had its last day as a publicly-traded company on October 22nd. Going forward, the company will continue to operate malls and shopping centers, but no longer has publicly tradable securities.

Retail Properties of America (RPAI) was acquired by Kite Realty Group (KRG) on October 22nd. As a result, this was the last day of trading for RPAI as the combined entity continues to trade under KRG. RPAI shareholders received 0.623 shares of KRG for each share of RPAI held. Retail Properties of America continues to operate as a subsidiary of Kite Realty. This acquisition significantly expanded KRG’s already substantial portfolio of grocery-anchored shopping centers.

CatchMark Timber Trust (CTT) had the worst performance of any REIT in October (-27.89%) due to the aforementioned abrupt exit from their Triple T joint venture. CatchMark took a substantial loss from their investment into Triple T and also lost the income from the management fee they were collecting from this joint venture. FFO/share was negatively impacted enough to drive CTT to slash its quarterly dividend by 43%. The sudden, sharp decline in NAV, FFO/share and quarterly dividend sent the share price plummeting.

EastGroup Properties (EGP) outperformed all other REITs in October with an +18.69% total return. EastGroup’s strong price movement was driven by impressive quarterly earnings in which they successfully capitalized on unprecedentedly good industrial fundamentals. EGP achieved re-leasing spreads of 37.4% on a GAAP basis and 23.9% on a cash basis.

79.78% of REITs had a positive return in October with 87.91% in the black year to date. During the first ten months of last year, the average REIT had a painful -26.5% return, whereas this year the average REIT has seen an exceptional total return of +30.93%.

Dividend Yield

Dividend yield is an important component of a REIT’s total return. The particularly high dividend yields of the REIT sector are, for many investors, the primary reason for investment in this sector. As many REITs are currently trading at share prices well below their NAV, yields are currently quite high for many REITs within the sector. Although a particularly high yield for a REIT may sometimes reflect a disproportionately high risk, there exist opportunities in some cases to capitalize on dividend yields that are sufficiently attractive to justify the underlying risks of the investment. I have included below a table ranking equity REITs from highest dividend yield (as of 10/31/2021) to lowest dividend yield.

Although a REIT’s decision regarding whether to pay a quarterly dividend or a monthly dividend does not reflect on the quality of the company’s fundamentals or operations, a monthly dividend allows for a smoother cash flow to the investor. Below is a list of equity REITs that pay monthly dividends ranked from highest yield to lowest yield.

REIT Premium/Discount to NAV by Property Type

Below is a downloadable data table, which ranks REITs within each property type from the largest discount to the largest premium to NAV. The consensus NAV used for this table is the average of analyst NAV estimates for each REIT. Both the NAV and the share price will change over time, so I will continue to include this table in upcoming issues of The State of REITs with updated consensus NAV estimates for each REIT for which such an estimate is available.

Takeaway

The large cap REIT premium (relative to small cap REITs) significantly increased during 2019 and further expanded during 2020. However, it has significantly narrowed during 2021. Investors are now paying on average about 31% more for each dollar of 2021 FFO/share to buy large cap REITs than small cap REITs (25.9x/19.8x – 1 = 30.8%). As can be seen in the table below, there is presently a strong positive correlation between market cap and FFO multiple.

The table below shows the average premium/discount of REITs of each market cap bucket. This data, much like the data for price/FFO, shows a strong, positive correlation between market cap and Price/NAV. The average large cap REIT (+11.93%) trades at a double-digit premium to consensus NAV and mid cap REITs (-0.29%) on average trade at approximately fair value. Small cap REITs (-10.46%) trade at a double-digit discount, whereas micro caps on average trade at less than 70% of their respective NAVs (-30.14%).

With REITs trading close to NAV and having largely rebounded to pre-covid pricing, is there still opportunity remaining? To what degree do REITs have the ability to grow? Given that REITs have substantially more liquidity than they did at the end of 2019 (an increase of 14% in total liquidity), there is enormous opportunity for developments, acquisitions and M&A. This potential for external growth coupled with the strong internal growth currently seen in multiple property types could fuel strong continued growth in the REIT sector over upcoming years.

Many REITs have taken advantage of the incredibly low interest rates over the past couple of years and locked in a substantial amount of low interest rate long term debt. This can be beneficial as rates are expected to meaningfully rise over the next 2 years and these very low rates will no longer be available. This has led, however, to an increase in the median net debt to recurring EBITDA from 6.2x to 6.8x for the REIT sector as a whole (data excludes hotels). Industrial (5.1x) and Self Storage (5.3x) have the healthiest debt/EBITDA, whereas Diversified (8.7x) and Office (7.3x) are on the more heavily levered end of the spectrum.

Despite the increase in leverage for many REITs, the median fixed-charge coverage ratio has actually improved from 3.6x to 3.7x thanks to refinancing at lower rates. Some REITs have also redeemed high-yield preferred shares and replaced them with lower yielding preferred shares. Despite holding more debt on their balance sheets, the majority of REITs are now better able to cover their interest and preferred dividend obligations than they were prior to the pandemic. Improved balance sheets coupled with increased liquidity provide REITs with ample room to continue to grow over upcoming years.

Important Notes and Disclosure

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

We cannot determine whether the content of any article or recommendation is appropriate for any specific person. Readers should contact their financial professional to discuss the suitability of any of the strategies or holdings before implementation in their portfolio. Research and information are provided for informational purposes only and are not intended for trading purposes. NEVER make an investment decision based solely on the information provided in our articles.

We may hold, purchase, or sell positions in securities mentioned in our articles and will not disclose this information to subscribers, nor the time the positions in the securities were acquired. We may liquidate shares in profiled companies at any time without notice. We may also take positions inconsistent with the information and views expressed on our website.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to our clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Through October 2021, The State of REITs was published exclusively on Seeking Alpha by Simon Bowler, Sector Analyst at 2nd Market Capital Services Corporation (2MCSC). Editions subsequent to October 2021 will be published on this website in addition to other platforms that may include Seeking Alpha. 2MCSC was formed in 1989 and provides investment research and consulting services to the financial services industry and the financial media. 2MCSC does not provide investment advice. 2MCSC is a separate entity but related under common ownership to 2nd Market Capital Advisory (2MCAC), a Wisconsin registered investment advisor. Simon Bowler is an investment advisor representative of 2MCAC. Any positive comments made by others should not be construed as an endorsement of the author's abilities to act as an investment advisor.

S&P disclosure: S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P.