Market Commentary | January 18, 2022

Inflation is here. Rate hikes are coming. Markets are anxious.

On 1/12/2022 the Bureau of Labor Statistics reported that in December the Consumer Price Index rose 7.0% Y-O-Y. This follows a November report of +6.8%. On 1/13 the Producer Price Index tallied that final demand prices moved up 9.7% in 2021, the largest calendar year increase since data were first calculated in 2010.

Pundit forecasts for the number of 2022 Fed Funds rate hikes quickly went from 1 to 2 to 4. Yield on the 10-year Treasury, which began 2021 at 0.93%, closed the year at 1.52% and finished the week with a 01/14/2022 closing yield of 1.78%. Short-term rates moved higher by an even greater magnitude.

In the first two weeks of the year, stock markets displayed a sort of restrained panic. Speculative issues like cryptocurrencies and non-profitable SPAC companies have seen their prices fall to as little as half of their recent highs. Blue chip stalwarts like Alphabet (GOOG), Microsoft (MSFT) and Amazon (AMZN) traded Friday to discounts from their 52-week highs of as much at -9.25%, -13.13%, and -15.29%, respectively. I don’t think this market pricing reflects the state of the tech giants’ operations or value, it is just what happens when everyone wants to sell at once.

So, what are we going to do?

Basically, we will continue on the same path that we have been on since the pandemic began almost two years ago. We try to identify business subsectors that will outperform as the economy evolves and then we invest in the companies that present the best opportunity.

As an example, it is widely perceived that we are experiencing a protracted housing shortage, specifically, affordable housing. Within affordable housing you can invest in multifamily or manufactured housing REITs. We own both, but we’ll focus on manufactured housing here. Manufactured housing captures inflation with rising rents and appreciating land values.

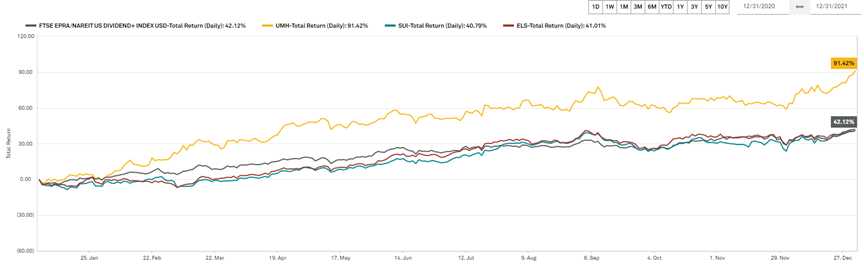

There are 3 established manufactured housing REITs trading on US exchanges. As the chart below illustrates, 2021 was a banner year for manufactured housing and extremely so for our pick, UMH Properties.

Each of these are well run businesses, but analysis revealed that UMH could be purchased at lower price/earnings and larger discount to Net Asset Value than either SUI or ELS. That is still the case today, despite the big share price run up in 2021. We expect UMH will deliver a solid result in 2022.

UMH increased its FFO/Share by more than 25% last year and consensus estimates are that this figure will grow by 17% in 2022 and more than 19% in 2023. After market on 01/12/2022, UMH increased its dividend by 5.4% (they raised by a similar amount last year, as well). Our communications with Anna Chew, UMH CFO, confirmed that, like over the last 5 years, this enhanced dividend will be characterized as a return of capital, thereby making it tax deferred for taxable investors until shares are sold.

In the rising interest rate environment, most REITs are enjoying significant balance sheet flexibility and UMH should actually be able to materially reduce its cost of capital in the coming 12 months. UMH has $462MM redeemable preferred shares that start to become callable beginning in July 2022. These two preferred series have coupons of 6.375% – 6.75% and carry an annual dividend/interest expense of more than $30MM. UMH should be able to refinance/redeem these issues with either debt or common equity issuance at a cost of capital of less than 4%; this translates to annual savings of nearly $12MM or $0.24/share. This savings goes directly to the bottom line and enhances UMH’s profit margins.

UMH is still fairly valued, we will hold and buy more if opportune pricing presents itself.

We presently see shares of growing companies available at reasonable prices in housing, infrastructure, energy, healthcare, and finance. If the markets get choppy, we will know which issues to buy.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.