Market Commentary | August 11, 2022

The Bipolar Markets

On July 28, the Bureau of Economic Analysis announced that real gross domestic product (GDP) decreased at an annual rate of 0.9 percent in the second quarter of 2022. In the first quarter, real GDP decreased by 1.6 percent. By some definitions, two consecutive quarters of decline signal that the economy is in recession.

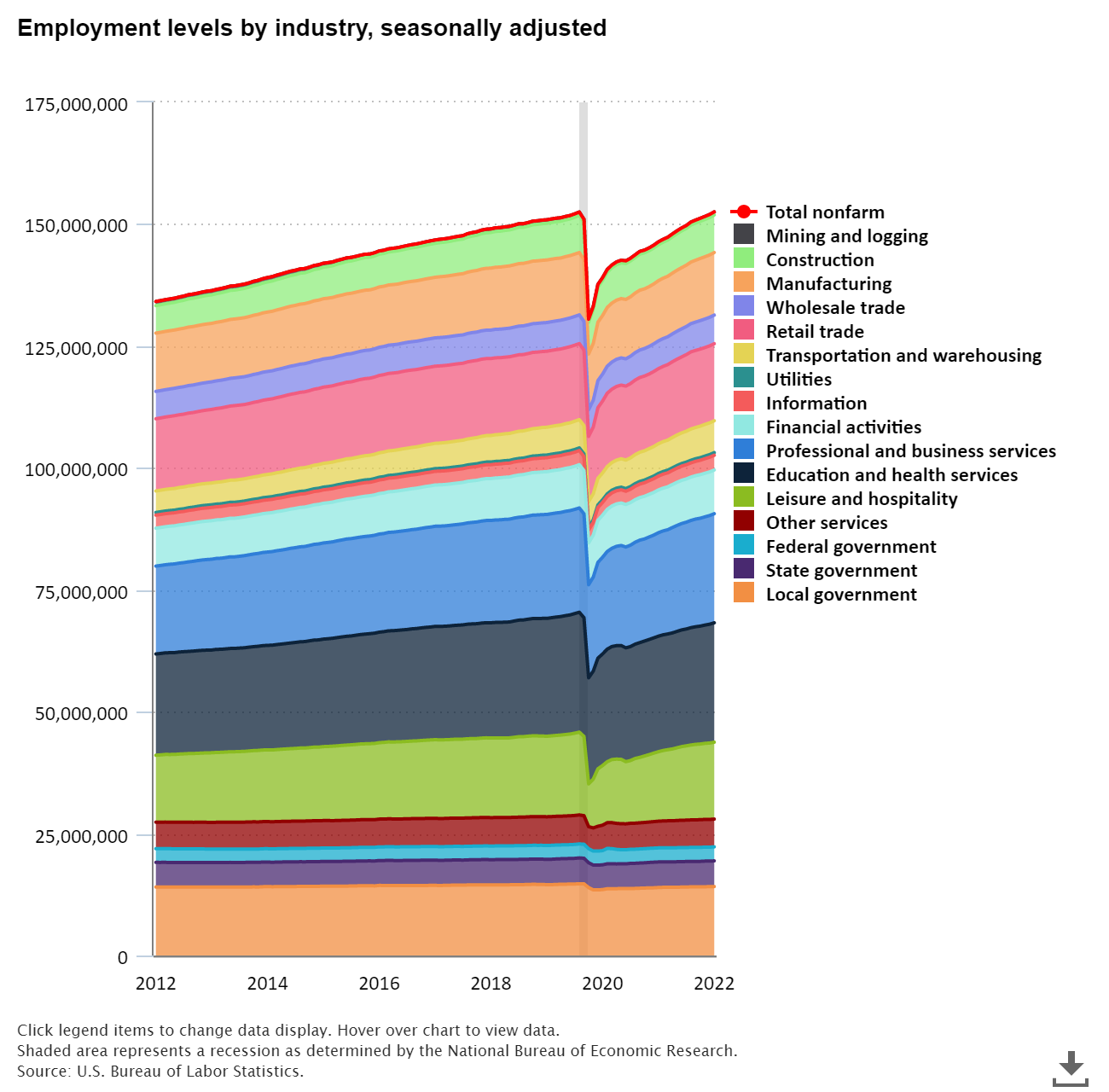

Stock and bond prices rallied on the news because investors hoped a recession might slow the Fed’s aggressive pace of inflation fighting interest rate hikes. The rally came to an abrupt end on August 5th, however, when the Bureau of Labor Statistics announced that the 528,000 new jobs created in July brought the unemployment rate down to pre-pandemic levels of 3.5%.

What’s an investor to do?

Stick to the Details

While macroeconomic news can create anxiety-inducing price gyrations, ongoing analysis of individual companies’ operations can uncover opportunity. For example:

*Armada Hoffler (AHH) announced the sale of 3 properties at 4% cap rates realizing $10s of millions in capital gains and providing ample capital to fund their development pipeline. AHH followed on with a 12% dividend hike.

*On April 28th Amazon.com (AMZN) announced that they were reversing their breakneck pace of acquiring/leasing additional distribution centers and would be subletting 10-30M square feet of their space; Industrial REIT share prices fell 20%, in response. Throughout July, one after another industrial REIT reported record revenues and earnings. Postal Realty (PSTL) reported a raft of 7%+ cap rate acquisitions net leased to AMZN’s biggest last-mile distributor, the U.S. Postal Service. PSTL then raised its dividend for the 12th consecutive quarter.

*UMH Properties (UMH) explained that supply chain issues hurt its 2nd quarter results but added that its July redemption of its Series C Preferred shares would immediately add $0.14/share to annual FFO. UMH has raised its dividend by 5% in each of the last two years and management says more hikes are on the way.

When shares fall on good news, you might do well to consider buying them.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.